Government Loan Schemes Invitation for Online Application for Various Loan Schemes for Lingayats.

Greetings to all. In today’s report, information is provided about various schemes (Veerashaiva Lingayat Scheme) available for the Veerashaiva Lingayat community. To join our Telegram channel for similar information, click here. Below is the complete information for everyone to read.

Veerashaiva Lingayat Community Loan Schemes: If you belong to the Veerashaiva Lingayat community, you are invited to apply for loans under various schemes for the development of Veerashaiva Lingayats and category 3B individuals for the year 2023-24 through Karnataka Veerashaiva Lingayat Development Corporation Limited. The list of loan facilities for various schemes in 2023-24 is as follows:

Basava Belaku Scheme

Basava Belaku Scheme: This scheme provides educational loans and is applicable for students pursuing vocational courses who belong to the Lingayat community.

Eligible applicants should have a family income limit of up to 3.5 lakhs. Students who are pursuing various vocational courses and making progress will receive a loan at an interest rate of 2%. If a student has availed a loan under the Basava Belaku Scheme in the year 2023-24, they can apply for a new loan along with a confirmation letter and the previous year’s mark sheet.

Jeeva Jala Scheme

Jeeva Jala Scheme: This scheme offers irrigation facilities and is applicable for small and marginal farmers in the Lingayat community. To be eligible, rural applicants should have an annual income of at least 98,000, and urban applicants should have an annual income of at least 1,20,000 within the income limit of 1,00,000.

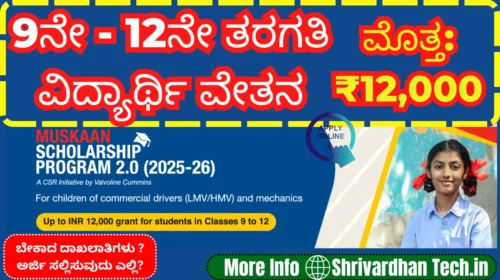

| Scholarship Scholarship | Click Here |

| Free Government Scheme | Click Here |

| Govt Jobs | Click Here |

Kaayaka Kirana Scheme

Kaayaka Kirana Scheme: This scheme supports self-employment opportunities for economically weaker sections of the Veerashaiva-Lingayat community. The scheme provides financial assistance and loan facilities as follows:

Component cost of Rs. 1,00,000/-: 20% maximum assistance of Rs. 20,000/- and remaining 80% as a loan at an annual interest rate of 4%.

Component cost of Rs. 2,00,000/-: 15% maximum assistance of Rs. 10,000/- and remaining 85% as a loan at an annual interest rate of 4%

Self-Employment Loan Schemes:

This scheme provides loans for agriculture-related activities and self-employment ventures. It is available for members of the Lingayat community. Under this scheme, individuals engaged in self-employment activities related to agriculture, trade, rental, and machinery can avail loans through cooperative banks and financial institutions.

If you have obtained a loan through cooperative banks, the corporation approves a subsidy of up to 20% or a maximum of INR 100 lakhs. The remaining amount can be obtained through a bank or financial institution, with the borrower bearing the interest as per the prevailing rates.

Entrepreneur Assistant Scheme:

This scheme offers loans for the purchase of yellow board cars for individuals interested in starting a taxi business. It is available for members of the Lingayat community. With support from cooperative banks, unemployed drivers can establish their own taxi businesses.

If you obtain a loan under this scheme, the corporation approves a subsidy of 50% or a maximum of INR 3 lakhs. The remaining amount can be obtained through a bank or financial institution, with the borrower bearing the interest as per the prevailing rates.

Vibhuti Production Center Establishment Loan Scheme:

This scheme provides loans and financial assistance for individuals engaged in the production of sacred ash (vibhuti). To set up a vibhuti manufacturing unit, a capital of INR 4.00 lakhs is required. The corporation provides a subsidy of INR 3,60,000/- and a financial assistance of INR 40,000/- annually as part of this scheme.

Community members interested in establishing a restaurant can avail loans under the Bhojanalaya Center Establishment Loan Scheme. For the establishment of a hotel, a capital of INR 5.00 lakhs is required. The corporation provides a subsidy of INR 4,60,000/- and a financial assistance of INR 10,000/- annually as part of this scheme.

Applicants must submit their applications by October 30th. For more detailed information, please visit the website https://kvldcl.karnataka.gov.in.

Important links to apply online

| Content | Download Link |

| Registration Application form | Click Here |

| Apply online Application form | Click Here. |

| Telegram Link | Join Now |

| WhatsApp Link | Join Now |

| Home Page | Visit websites… |

If you belong to the Lingayat community or fall under the 3B category, carefully read the entire document and utilize the benefits of these schemes.